What is a Chart of Accounts?

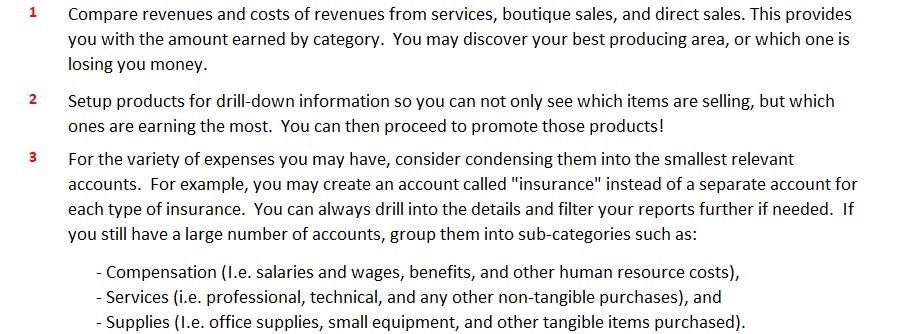

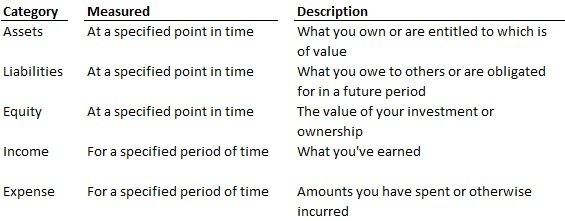

The Chart of Accounts is a list of accounts used to account for your business transactions. Each account falls into one of 5 major categories (although these are sometimes called by different names):

Garbage-In, Garbage-Out

When it comes to measuring results (and so many other things), the concept of “garbage-in, garbage out” is a meaningful statement! When you setup your accounting system, the structure of your accounts (i.e. chart of accounts) will determine the information available to you from your accounting records when you need to make a decision, get your taxes done, undergo an audit, etc. Having messy records can cost you some serious extra $$!

All too often we find that companies (both small and large) do not spend much time setting up their account structure, and just start entering transactions as they occur. Most out-of-the-box software for accounting include standard sets of accounts that are used by all sorts of enterprises. Although such standard setups are convenient and can help provide a good starting point, the accounts used are not aimed directly at helping you and your specific business achieve your goals. This results in reporting that is difficult to understand or provides little information that is relevant to you and your business.

Our Method

As we act as CFO or Controller (head of an accounting department), whether directly for a company or as an outsourced solution, the first thing we like to do is update the chart of accounts. The goal is to set up a structure that provides relevant reports with information that can be easily entered, understood, and analyzed. We recommend using account numbers as well, as this can help you organize the accounts (which can become to a long list as your company grows) into useful groups or categories.

As a best practice, use different levels of numbers for each of the 5 major categories, such as 10000 for assets, 20000 for liabilities, 30000 for equity, and so forth.

Example:

Let’s say you have a small woodworking business providing crafts to boutique stores and also direct selling to customers through your website. Let’s also say that your business provides installation services for custom projects. What information would be most relevant to you? Here are just a few suggestions: